- #Irs file extension how to#

- #Irs file extension code#

- #Irs file extension plus#

- #Irs file extension download#

An employer may, however, report the contribution for the prior plan year when filing their tax return.

#Irs file extension code#

#Irs file extension plus#

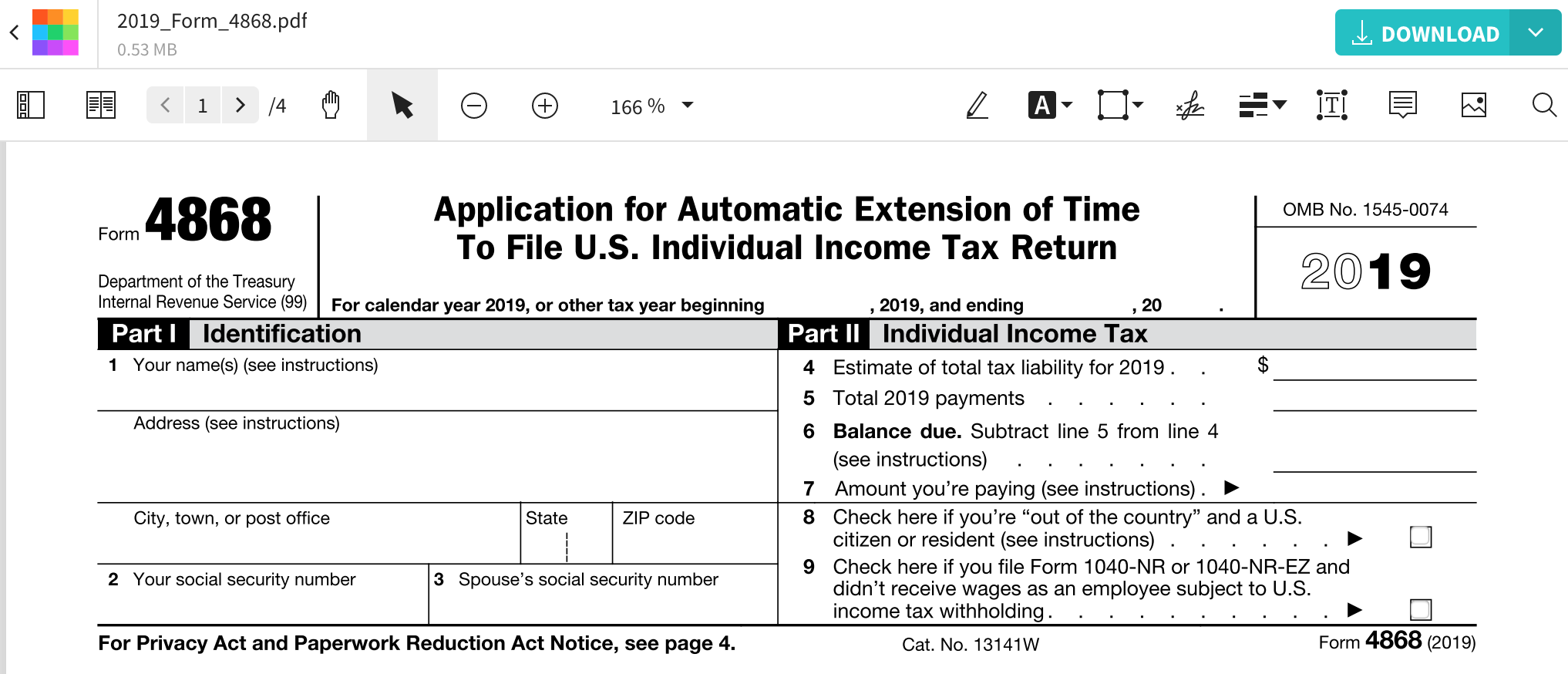

You can make employer/profit sharing contributions up until your business’s tax filing deadline, plus extensions. Your individual 401(k) plan must be set up by your business’s fiscal year-end.You must continue to fund your SIMPLE IRA (savings incentive match plan for employees) until year end.However, any taxes you owe are still due on April 15. 15 deadline to file the paperwork for your individual tax return. If you are self-employed and filing for an extension for your personal taxes, you will have until the Oct.Your tax return will not be due until Oct. Following the Form 4868 instructions, mail or electronically file the extension form with your payment by the April 15 deadline instructions for each are included on Form 4868.

#Irs file extension download#

#Irs file extension how to#

How to file a tax extension for an individual By filing an extension and making a large enough payment, you may be able to avoid interest charges as well as any IRS penalties related to late filing and/or late payment 2. The penalties for failure to file a tax return or pay taxes when due can increase your tax bill the longer you delay, and can each approach 25 percent of the tax due. If you owe any taxes, payment is still due by April 15. Your tax payment may be reduced by any amounts already paid through withholding or prior estimated tax payments. We'll provide the mailing address and any payment instructions.You still have to pay taxes owed by April 15įiling for a tax extension only means you can extend the deadline to submit your tax paperwork.

If you're using TurboTax Business to prepare your return, you can also print a 7004 through the program:

One way to file Form 7004 is by downloading and printing the form from the IRS website, filling it out according to the IRS instructions, and mailing it to the address given on page 4 of the instructions. Corporation Income Tax Return (unless the fiscal year ends June 30, in which case the return is due Septemand the extension gives another 7 months to April 15, 2022). Return of Partnership Income and 1120S, U.S. For tax year 2020, the IRS Form 7004 extends the May 17 deadline for another:

0 kommentar(er)

0 kommentar(er)